Five Real Estate Trends for 2016

What are the five real estate trends for 2016? One given by Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s J. Mack Robinson College of Business predicts strong job growth, rising home prices and continued stock market appreciation, but global tensions and lack of business spending are cause for concern.”

What are the five real estate trends for 2016? One given by Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s J. Mack Robinson College of Business predicts strong job growth, rising home prices and continued stock market appreciation, but global tensions and lack of business spending are cause for concern.”

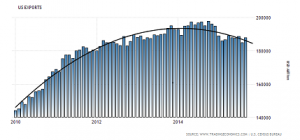

A sharp decline in export growth is also contributing to the forecaster’s tempered expectations. “Exports represent foreign demand for our goods, and as such, they are a reflection of our trading partners’ economic health, which is iffy to say the least.” Anxiety prevails over the Middle East, Germany’s dependence on Russian energy sources, and mounting debt temper optimism. Furthermore, China’s continued stagnation is impacting its suppliers in the emerging markets. All this will ultimately impact financial markets back at home.

When he talks about “…exports reflecting our trading partners economic health,” we need to also recognize that we have less manufacturing capacity. Both trends are evident in the chart of exports since 2010:

So, Trend number one is the U.S. Dollar. Right now the Dollar is trading at highs last seen in March, 2015. A rising Dollar depresses exports, making our goods more expensive overseas. The Dollar is buoyed by rising interest rates and by foreigners looking for a safe haven from the world’s woes. If the Federal Reserve raises interest rates it will make the Dollar stronger.

That also means Trend number two: Interest rates stay low. Daren Blomquist of RealtyTrac even says the industry is “addicted” to low rates and Ben Bernanke said we would not have normalization of rates in our lifetime.

Trend number three is low oil prices. There is currently an oversupply of oil in the world and large quantities are stored in tankers off shore in the U.S. and many countries. Many oil producers are in so much debt that their companies are in peril of bankruptcy. Expect oil prices to stay low and prices at the pump to even go lower.

The one thing that could upset the trend is our Trend number four: War.

Many analysts see parallels between the late thirties and today. There are so many potential flash points in the world today. It is a task to even list them. Someone somewhere could make a mistake and the war would be on.

The fifth Trend for 2016: is housing affordability. For a quarter of a century, back to 1990, median incomes adjusted for inflation have been flat. Yet, housing prices in many places are higher today than they were before the housing crash. The gap is wider than ever today. Renting is not a solution. Renting requires a bigger slice of take home pay than home ownership, leaving little savings for the down payment.

If the economy continues to improve, and wages play catch up, mortgage rates stay low, and oil prices stay where they are or even go lower, housing should be a good investment. The market will continue to be a seller’s market and 2016 in Atlanta will look much like 2015.

At Val Buys Houses LLC, we specialize in helping homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple honest truth about your home. We buy for cash, therefore we can help you sell it fast to resolve any situation, or give you as much time as you need.

We care about our community in Cobb county and Atlanta. At Val Buys Houses LLC we take a lot of pride in providing excellent customer service. We have come across all scenarios, we are not here to judge; only to help.

Give us a call today at 404-844-8845 and let us see if we can help YOU!