Avoid Atlanta Foreclosure

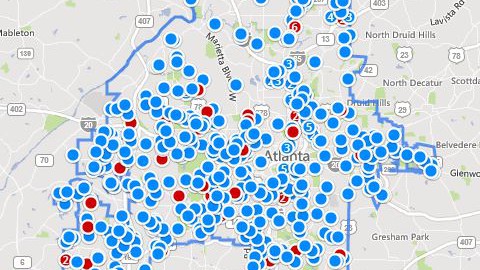

Currently, according to Zillow, the owners of almost 2,000 homes are in danger of losing their homes. (Only 500 are pictured above.) Many have failed to avoid Atlanta foreclosure. Foreclosure doesn’t arrive unannounced like a baby on the doorstep. There are signs of approaching trouble. There is difficulty making the mortgage payments in a timely manner. There is a lack of savings for emergencies. Credit cards are used to get to the next pay day. Each month only the minimum is paid on the credit cards. Finally, doctor and dental visits are a thing of the past.

Currently, according to Zillow, the owners of almost 2,000 homes are in danger of losing their homes. (Only 500 are pictured above.) Many have failed to avoid Atlanta foreclosure. Foreclosure doesn’t arrive unannounced like a baby on the doorstep. There are signs of approaching trouble. There is difficulty making the mortgage payments in a timely manner. There is a lack of savings for emergencies. Credit cards are used to get to the next pay day. Each month only the minimum is paid on the credit cards. Finally, doctor and dental visits are a thing of the past.

Don’t ignore the problem. If you are experiencing any of the signs of approaching troubles, and not doing anything about it, you are ignoring the problem.

Know the process of foreclosure – In Georgia the foreclosure process is a relatively quick process, taking only a couple of months. If you miss a mortgage payment, there is a grace period but you will be charged a late fee generally 5% of the overdue payment of principal and interest. If you miss a few mortgage payments, your mortgage servicer will probably send a letter or two reminding you to get caught up, as well as call you to try to collect the payments. Don’t ignore the phone calls and letters. This is a good opportunity to discuss loss mitigation options and attempt to work out an agreement (such as a loan modification, forbearance, or payment plan) so you can avoid foreclosure.

If you do nothing, after the mortgage servicer has waited until you are 120 days delinquent on payments, the mortgage servicer can file first official notice or filing for any judicial or non-judicial foreclosure. This is to give you more time to explore your options.

Next comes the breach letter and you have 30 days from the letter to cure the breach of payment. Failure to cure the default on or before the date specified in the notice may result in acceleration of the debt and sale of the property.

Do not ignore your mail – When you ignore the problem or hide from your mail you will miss a letter from the lender called “the first a notice of default,” which is a letter telling you that you have missed a number of mortgage payments. Many have been in your shoes. The first thing they did when the mail came was to throw the bills in a box. The first envelopes will contain helpful suggestions to get things under control. Then will come legal action. Ignoring these notices can cause you to lose everything.

Know your rights – You can participate in pre-foreclosure mediation with your lender to discuss options to avoid foreclosure. Also, once the foreclosure has started, you have the right to cure the mortgage default by paying the past-due amounts, although you must do so within a certain period of time before the sale.

You can fight the foreclosure by challenging the technical rules or you can seek bankruptcy. Credit.com says, “A bankruptcy filed before the foreclosure sale will “stay” or temporarily stop a foreclosure…”

Contact professionals – Your banker may be able to refinance the loan or your creditors may be able to give you repayment options. You may have an option of a short sale, rather than foreclosure. Contact a credit counselor. Sure you will feel like a failure or worse, but take responsibility for your actions. Seek legal advice from a bankruptcy attorney. That sounds contrary to taking responsibility, but you need to know your options so you can make informed decisions. If you seek legal advice when breach letter arrives, you may be able to delay or avoid foreclosure.

At Val Buys Houses LLC we specialize in helping homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple honest truth about your home, we buy cash, therefore we can help you sell it fast to resolve any situation, or give you as much time as you need.

We care about our community in Cobb county and Atlanta. At Val Buys Houses LLC we take a lot of pride in providing excellent customer service. We have come across all scenarios, we are not here to judge; only to help.

Give us a call today at 404-844-8845 and let us see if we can help YOU!